HR Tech Consolidation Wave: Strategic Analysis of Jobget-Snagajob, Adzuna-Seiza, and GlobalData-Linkup Acquisitions

This week brings us a fascinating series of acquisitions in the HR Tech landscape, each telling a unique story about where our industry is heading. While acquisitions aren't unusual (TextKerner's recent acquisition by Bullhorn comes to mind), seeing three significant moves in a single week warrants a deeper analysis.

Key Developments:

- Jobget's acquisition of Snagajob merges modern mobile-first technology with a dot-com era giant

- Adzuna's purchase of Seiza signals a bet on social media recruitment

- GlobalData's Linkup acquisition validates alternative monetization of employment data

In this article, I will explore the implications of each acquisition, examining how they might reshape the industry and what challenges and opportunities they present for the stakeholders involved.

Jobget gets Snagajob

Only some people remember that Snagajob has been around for more than 25 years, and it is, more or less, a dot-com bubble survivor with an impressive SEO footprint.

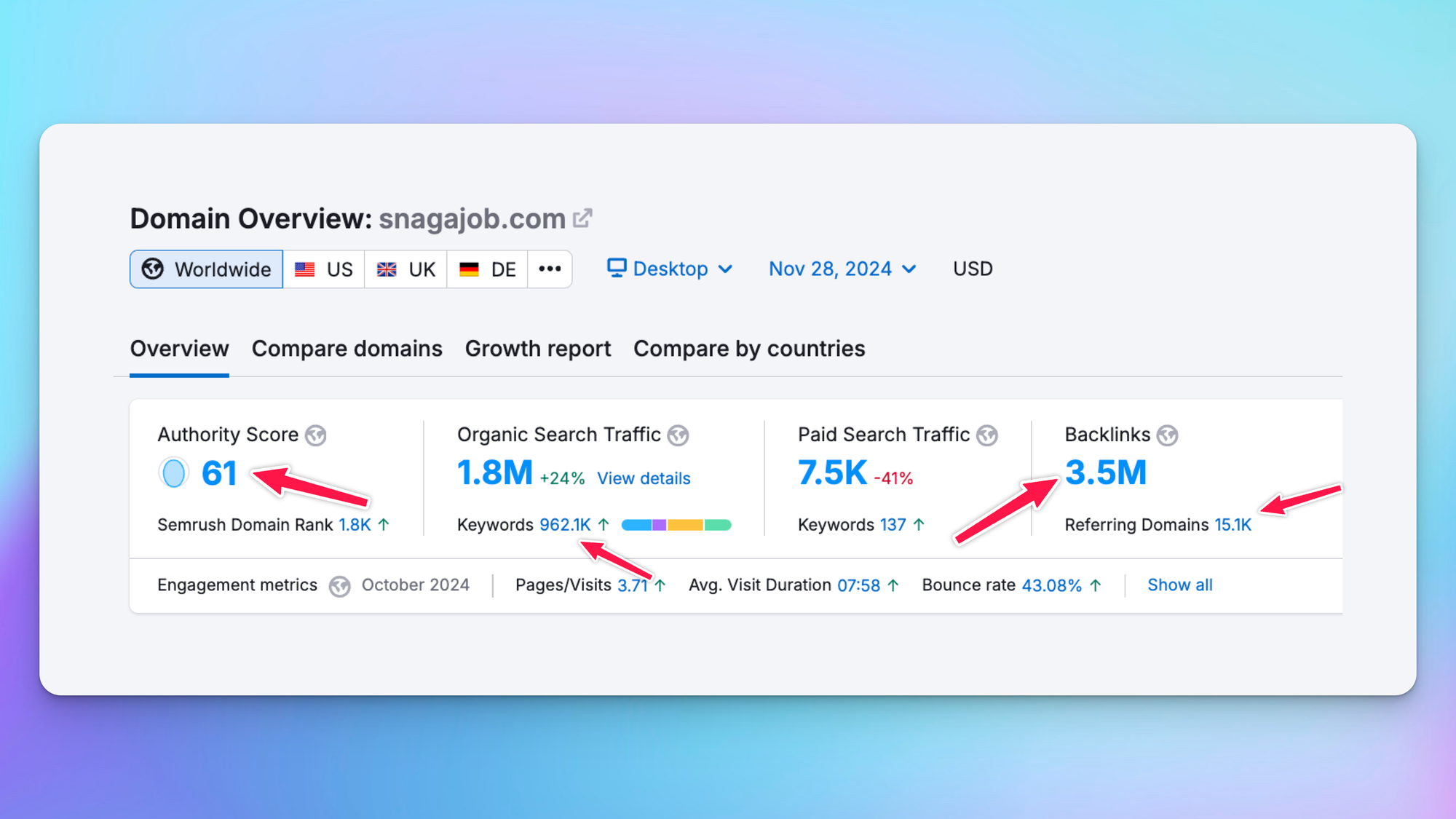

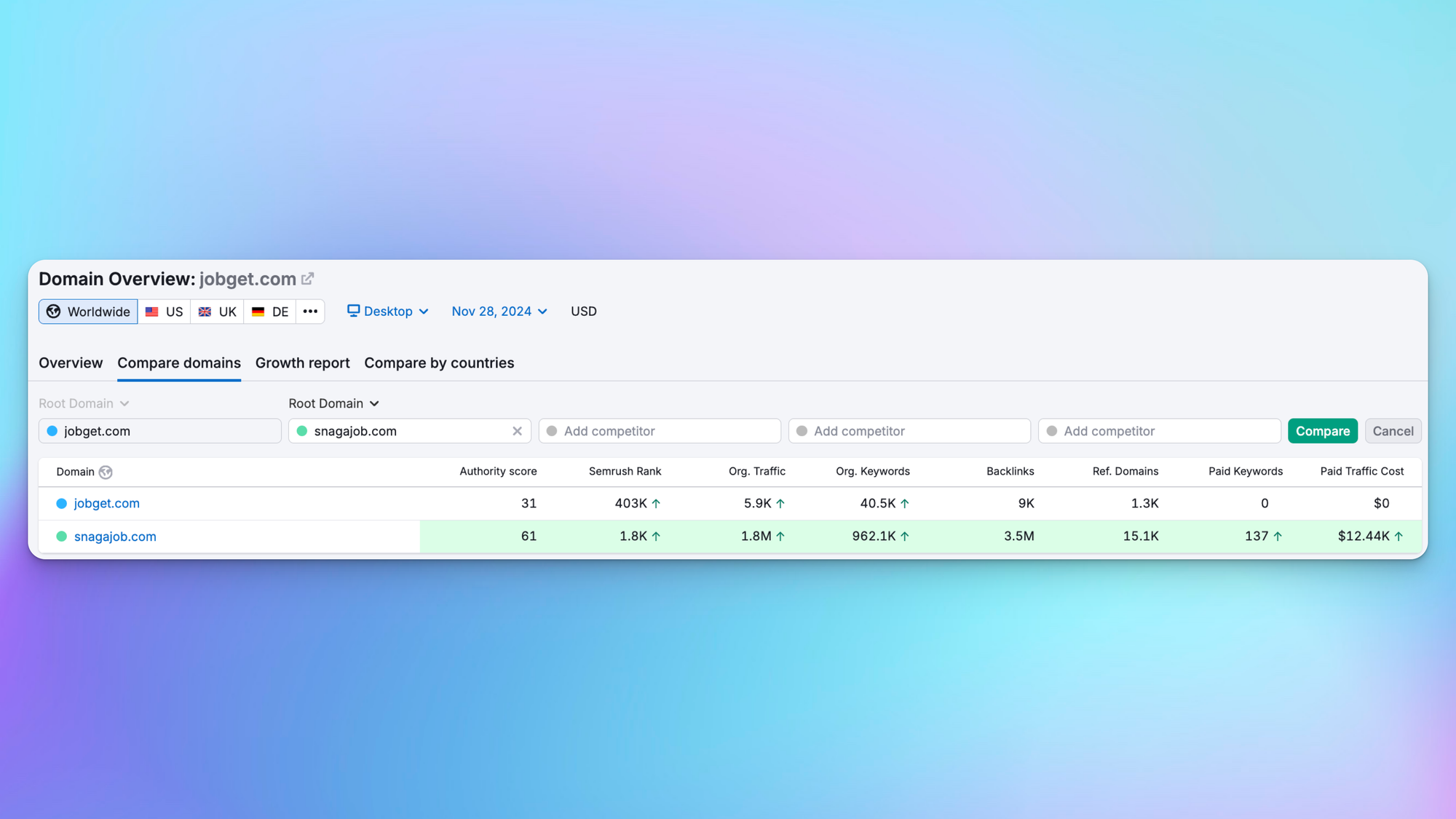

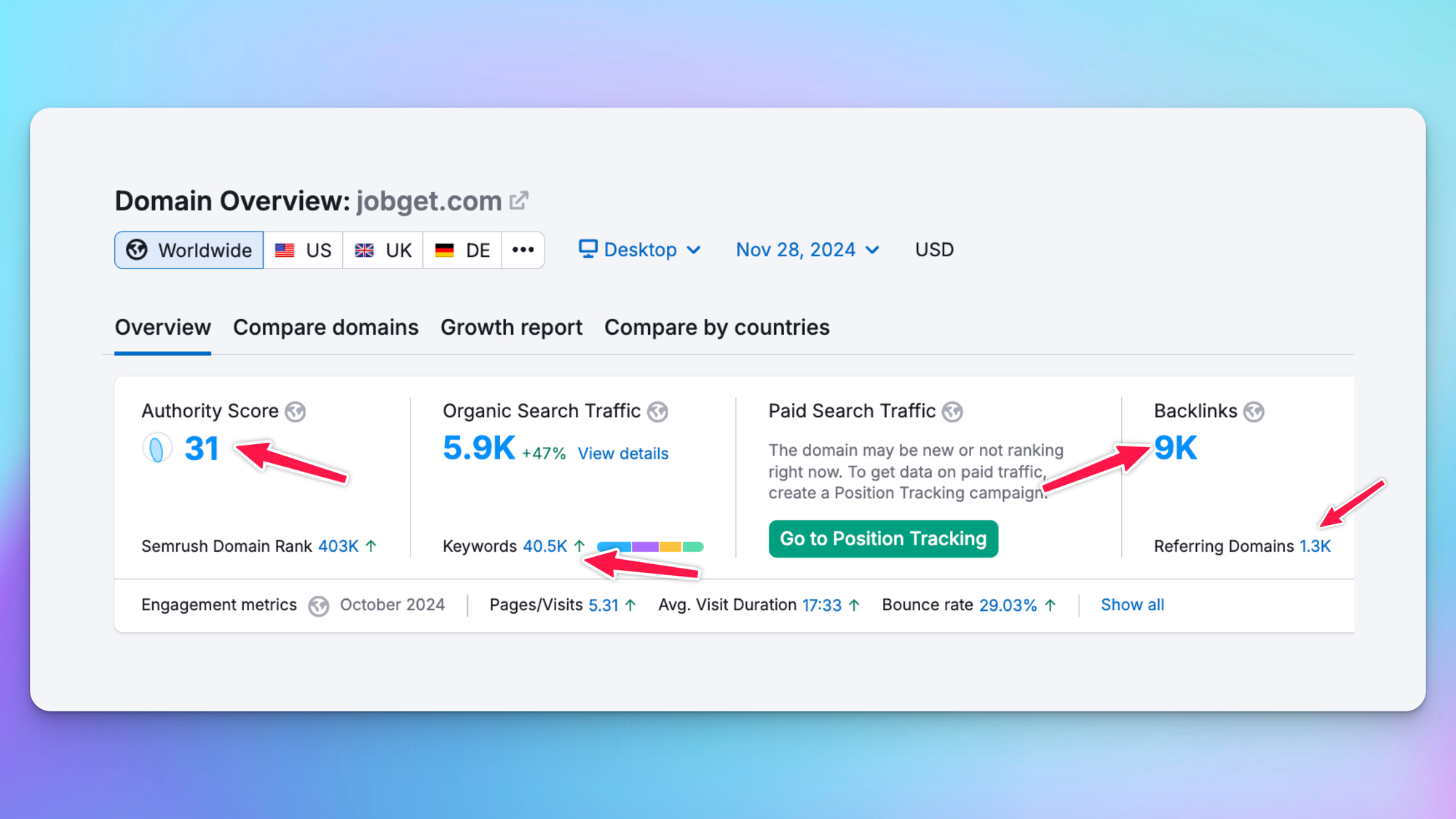

I am not active in the hourly work segment, but from an SEO perspective, Snagajob is a behemoth compared to Jobget. Even looking at the most basic stuff like backlinks, the latter has 8K, the first 3.5M. Minor difference 😊. According to SEMRush, Snag ranks for 900K keywords, Jobget for 27K.

Oh, how much does Google love these old domains?

So, buying an asset with such an organic footprint will have a solid effect on your bottom line—every click you don't have to buy improves the P&L.

The only thing that does not check is the math. Snag raised something like 400MM over its existence, and Jobget raised more than 10% of that. This funding baseline tells you that the buying price has to be relatively low.

I am not surprised. This is consistent with the company's recent developments—multiple layoffs and very little marketing activity.

How does that look strategically?

The merger of both platforms is quite problematic. Jobget is a mobile app. Snagajob is a classical job board-type site. The value of the organic traffic is in the millions of pages indexed.

Maintaining the momentum of this organic traffic machine is a complex task. Migrating Snagajob and redirecting to Jobget could potentially harm the domain. The best approach would be to either integrate Jobget into the existing domain and kill the brand (which has very little value compared to Snag) or inject the Jobget openings into Snag, a challenging yet rewarding project for an SEO expert in the job board space.

That would be a very cool project for someone with SEO expertise in the job board space.

For now, the decision is to keep both brands alive and separate, just sharing the data between the databases.

This is the best and least risky approach for now, but I advise taking over the Snagajob brand and building on top of it.

Technical Debt

When discussing candidate databases and technology, people can greatly underestimate the effort to maintain a 25-year-old job board. This giant has a lot of legacy and technical debt, and I am unsure how much of the original team is still around.

I have helped countless companies migrate their old jobs to a more current tech stack and my advice to Jobget is to keep the key tech people around and keep them happy. These platforms rarely work without a range of issues that need constant attention.

Unifying the databases, deduplicating profiles, and normalizing the data so that both databases can provide candidates with the same quality will be a considerable challenge.

The same applies to SEO, too. This majestic beast needs constant feeding of improvements and monitoring.

Adzuna acquiring Seiza

To be completely blunt, I have little knowledge of Seiza, and everything I write below is based on browsing their site and speaking to a few people. However, I have had the opportunity to work alongside Jobiqo, supporting them in building Jobiqo AIR, which has a full-fledged social media advertising product.

Why Adzuna needs a social media hiring platform is beyond me.

I listened to Doug Monro from Adzuna explain why they acquired the company on the ChadNCheese podcast, and unfortunately, I am not convinced, especially the part about Adzuna focusing on hourly/frontline workers (lol, this was new to me).

Here is what I think:

Looking at the site, Seiza boosts with 40K campaigns run and 2 days to launch your campaign. Why does it take so long? You can use several vendors on the market and have a social media campaign up and running in an hour. There is no innovation or anything special here.

What is the historical value of the campaigns? This is a relatively small number on which to base statistical models. Additionally, Meta and TikTok provide such good bidding optimization tools that I hardly believe any ad campaign manager can improve performance by optimizing bids.

What else is there? No generative AI-powered video generation for TikTok or Meta.

What I like about them is that they are not doing the whole "AI" pitch (but Doug did). A basic scoring algorithm, interview scheduling, and texting are all built into a simple ATS. This is quite advantageous and currently missing at comparable social media recruiting advertising providers but also attractive for mostly small employers without an ATS.

So, this acquisition is planned as a revenue multiplier. After all, the social media budget gets booked as revenue, and then the spending is subtracted as cost. On the P&L, it still looks like a huge revenue boost.

Then there is the topic of all programmatic vendors like Appcast and Recruitics going in on full-service, embracing social media, so having something in your sleeve to counter their offering is also lovely.

I don't buy this pitch about Adzuna's ability to reach 4 billion people. Any company can claim this by running a display advertising campaign on Google.

GlobalData acquiring Linkup

Here is some background on Linkup, as it is a reasonably exciting company in our space.

I first used Linkup's services when working at a niche German white-collar b2c monetizing job board.

Linkup came at a great time as our cost for external scraping was crazy high, and their offering was at least 80% cheaper than what we got from the scraping providers.

It is worth noting that back then, there were four leading providers of scraped content - Aspen Tech Labs (still active), Propellum (not sure they are active anymore), TextKernel's JobFeed, and Linkup.

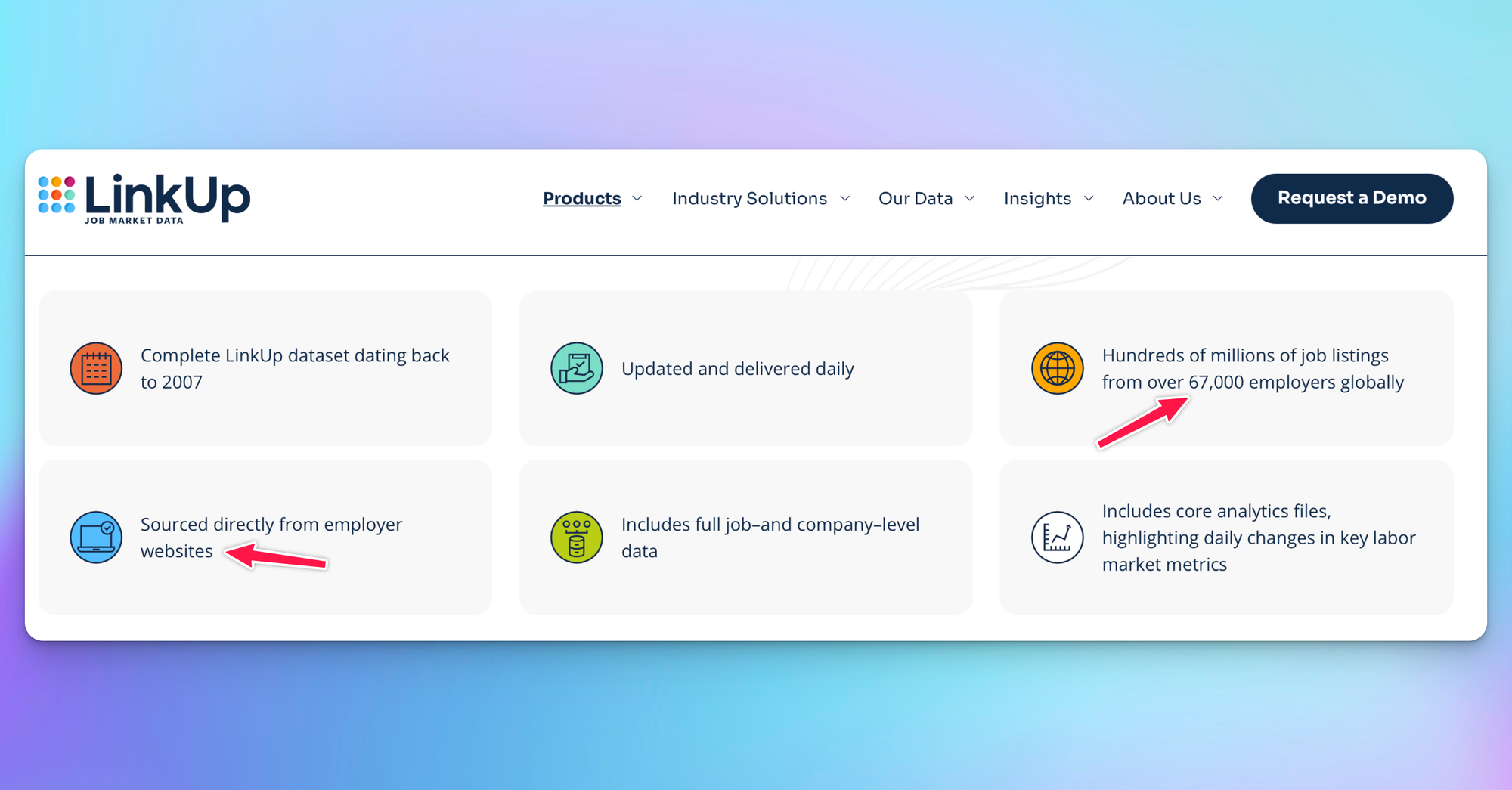

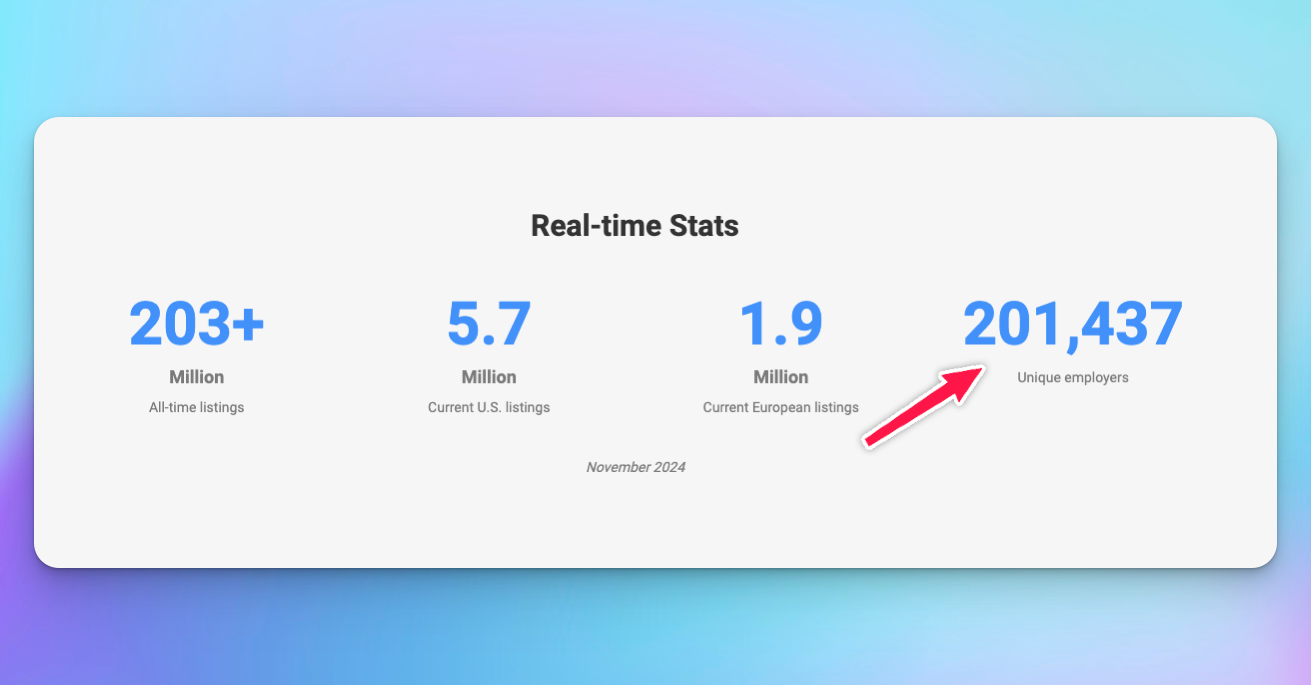

The main difference was that Linkup had a 100% ATS-based feed with excellent quality. Word on the street was that they had outgoing integrations from the ATS with the jobs, and their quality was so good that this is most likely true.

Job scraping is a very low-margin business, and customers would always look for a cheaper provider. In my honest opinion, job scraping is an industry where you can be profitable, but you will never build an eight—or nine-figure business unless you sell this data smart.

Here, Linkup boldly moved early and decided to sell to financial services companies (deep pockets) rather than job boards and aggregators (trying to negotiate every cent). Real-time employment data can be precious if you take bets against the market.

However, there is a small but. Linkup only covers data from 67K companies worldwide (not the US). The US alone has 33.2 million companies, and although most are not relevant for scraping, the number indicates their focus on getting jobs from ATS platforms only.

Compared to Aspen Tech Labs, which advertises 201K companies, Linkup needs to catch up in this area, as the first one has much more long-tail data.

So, if someone from the financial services sector looking for a more complete picture of the labor market, knows what to do.

Summary

This week in HR Tech, we witnessed a remarkable wave of strategic acquisitions illuminating our industry's evolving dynamics. From Jobget's acquisition of hourly work giant Snagajob (a fascinating merger of mobile-first technology with dot-com era SEO dominance) to Adzuna's strategic expansion into social recruitment through Seiza and GlobalData's clever move to leverage Linkup's employment data for financial services – each deal reveals distinct strategies in the ongoing consolidation phase in HR Tech.

If you enjoy detailed analysis of HR Tech industry developments, consider subscribing to my blog. I regularly explore strategic acquisitions and their implications for the broader recruitment ecosystem.