2022 Predictions - Crypto, DeFi and Web3

The excellent question is, who am I, and why am I qualified to make predictions about this space? My involvement in the Crypto / DeFi / Web3 space is mostly through Crypto Careers - a job platform I created to help people that want to work in this exciting industry. Companies worldwide use the platform to find talent for their crypto jobs, and seeing where the demand for talent is focused is a perfect indicator of where the industry is heading. Besides that, I have been actively investing in early-stage crypto startups since 2016.

Finally, I believe that decentralized blockchain technology can improve our financial system for good, so I try to keep up with the latest technological developments in Crypto to form a long-term investment hypothesis. Nevertheless, Cryptocurrencies are a wild rollercoaster; there is no guarantee for anything; black swan events can happen at any time and wipe out large parts of the market. None of this is financial advice!

1. We are not going to have a bear market in 2022

So this is a big one - after the crazy growth in 2020 driven by DeFi and the continuous growth in 2021 driven by layer 1 protocols and (here is a great article that explains the difference between layer 1 and layer 2 blockchain protocols) NFTs, most people expect a cool-off. I think that the market will see moderate growth in 2022 with some heavy corrections along the way, but not a real bear market. At the end of 2022, the prices of the blue-chip cryptocurrencies, DeFi and Layer 1, will be higher than today. There are many drivers for this:

- Inflation is driving asset prices further. There is no clear indication that governments will stop printing money.

- Further gamification of Crypto will increase market pressure, driving prices even higher - the number of people investing from their phones worldwide is growing and Robinhood clones worldwide were emerging like shitcoins in 2017.

- Wide adoption of Crypto - the number of active addresses grows on all significant blockchains. Metamask just crossed 10 million MAUs

2. The top 3 layer 1 protocols will surpass ETH in market cap

The top 10 layer 1 protocol besides ETH (Solana, BSC, Algorand, Polygon, Avalanche, Tezos, Terra, Polkadot and a few smaller ones) have a combined market cap of about half of Ethereum (which is $550bn, by the way). By 2022, the three most prominent Layer1 protocols will surpass ETH in market cap. It is hard to predict which ones exactly, but my bet is Solana, Avalanche and Algorand.

3. By the end of 2022, Solana is going to be the second-largest layer 1 protocol after Ethereum by market cap

This prediction is a no-brainer if you have used any existing layer 1 alternatives to Ethereum and compared the UX to Solana. Solana and the corresponding infrastructure WORKS. It is easy and fast, and it does not crash. With the FTX and Alameda backing, these guys have no stop.

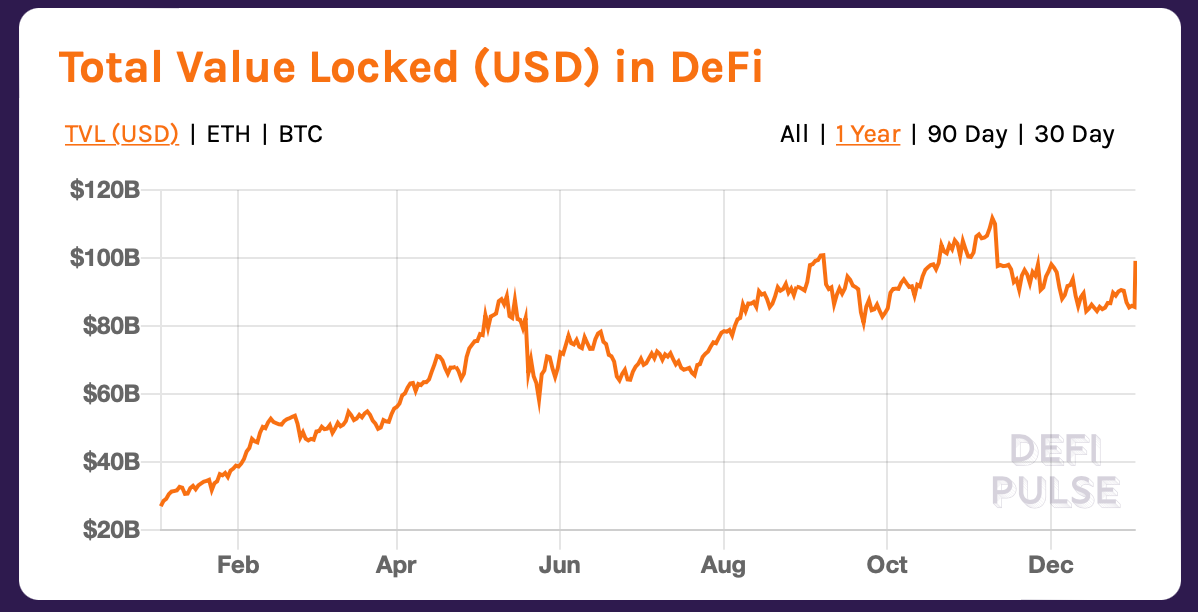

4. TLV in DeFi will cross $1 Trillion

Depending on how you measure it, DeFi Total Locked Value has already crossed either $100Bn or $200Bn this year. I don't see any reasons why this growth will slow down. The hunger for yield from traditional markets is here and DeFi protocols have been working hard on allowing the average Joe to earn a good return on their stablecoins.

5. NFTs hype will wear off

NFTs' trading volume surpassed $13Bn in 2021. Magic internet JPEGs are expensive. I am not saying that NFTs will disappear - not at all. I think they are here to stay and Facebook going all-in into Metaverse is a solid confirmation that digital goods will be a part of our lives. However, the NFT market is overhyped and we just experienced something similar to the 2017 ICO craze in Crypto. If you need a reminder, everyone was printing money at the end of 2017. Such irrational exuberances are always a red light for me - if everyone is getting rich making random bets, the party is already over.

6. Web3 is going to become an actual (productive) industry

Crypto tried to rebrand itself to Web3 this year. I think this has been a success so far - the Internet of ownership is a romantic vision of how the Internet could have evolved in the 80s, but it did not. Web3 has some clear benefits but has issues - predominantly around the scalability of the most popular blockchain powering Web3 right now - Ethereum. However, as discussed above, alternative Layer 1 blockchains like Solana exist. These protocols scale, but they have issues with how decentralized they are. This will be an exciting development to follow - there is a constant trade-off between how decentralized a protocol is and how scalable it can be.

Thank you for reading! I hope you liked the post. Feel free to subscribe to my newsletter:

Do you want to discuss this further - reach out to me on Linkedin!

In case you want more predictions, you can check out my: